Colorado homeowner sees nearly $440 jump in monthly insurance bill. Here's why some may see higher rates

Homeowners insurance is getting more expensive, and in a high-risk state for hail and wildfires, some Coloradans are feeling the financial pinch. Rocky Mountain Insurance Association says Colorado ranks second in the nation for hail insurance claims and ranks second for the number of homes in high-risk wildfire areas.

Colorado also has the sixth-highest homeowners insurance premiums.

In the 25 years she's lived in Broomfield, Melinda Endres says she's never seen a bill like this June's mortgage.

"I thought it was a mistake. I thought, are you kidding?" Endres said, "We get this letter saying that it's going to increase to over $2,000 now, and that's more than $300 a month."

So Melinda said she called her broker, and they told her that her home insurance had shot up, with the only chance of a lower monthly bill coming at the cost of a new roof.

When CBS Colorado Your Broomfield Reporter Sarah Horbacewicz asked if she could afford the jump, Endres said, "Who could? I mean, it's really not, not at all something we want to do, but we just have to figure out what to do next."

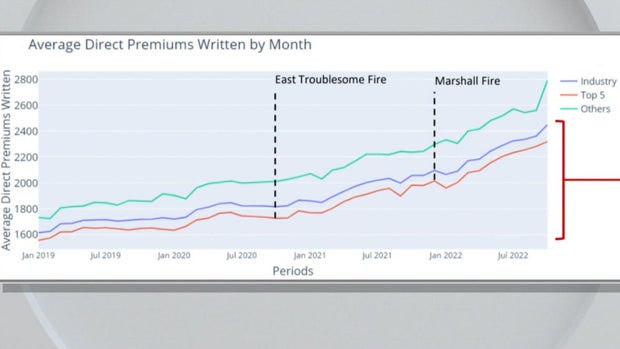

And Endres is not alone, according to a Colorado Department of Regulatory Agencies study, between 2019 and 2022, Colorado premiums went up more than 50% on average. That timeline includes rates through the East Troublesome and Marshall Fires.

Carole Walker is the Executive Director of the Rocky Mountain Insurance Association. Now she says she sees stories like Endres's every day.

"We are in the hardest market in a generation for property insurance," Walker said, "We've always been a high risk hail state, we've always been a high risk wildfire state, but now we have more people living in the path of that, and unfortunately, we're seeing more record breaking catastrophes."

Walker is also seeing more high-risk properties unable to get market insurance. Now the industry is pushing for ways to keep people and homes protected from hail and wildfire, by doing things like installing new roofs.

"I think for a lot of years, we said, yeah, we need to do something. But we're not at critical mass. I think we're now at that tipping point where we really have to be addressing our risk in Colorado," Walker said.

But for many homeowners, it all comes down to cost, and Melinda could soon be priced out of Colorado.

"I will probably move on," Endres said, "because of fire insurance."

For anyone who may have seen a similar rise in their bills, Rocky Mountain Insurance says homeowners may want to shop around before canceling any policy, as they could get stuck with even higher costs or pushed to the FAIR plan.